Quantifying Cyber Risk Is Overwhelming.

Delta RQ quickly and cost effectively assesses an organisation’s cyber risks and quantifies expected financial losses due to cyber incidents.

Prioritise cyber investment based on risk models certified by cyber insurers

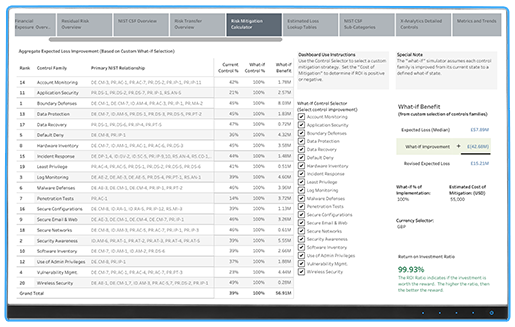

Delta RQ calculates financial values of expected loss reduction for each security control - enabling existing security budgets to be assessed against risk impact. Security controls which provide marginal impacts on expected loss reduction can be reduced and funding reprioritised, to controls that provide clear expected loss reduction. This enables information security teams to maximise each security control’s return on investment.

Delta RQ: Cyber Risk Value Proposition

Cyber Risk

- Calculate value at risk accurately in real financial impact terms.

- Assess systems/NIST controls for effectiveness against cyber threats.

- Explain cyber security risk to the Board and Stakeholders.

- Mitigate supply chain compromise threat vectors.

Cyber Strategy

- Calculate value at risk accurately in real financial impact terms.

- Assess systems/NIST controls for effectiveness against cyber threats.

- Explain cyber security risk to the Board and Stakeholders.

- Mitigate supply chain compromise threat vectors.

Cyber Investment

- Calculate value at risk accurately in real financial impact terms.

- Assess systems/NIST controls for effectiveness against cyber threats.

- Explain cyber security risk to the Board and Stakeholders.

- Mitigate supply chain compromise threat vectors.

Cyber Insurance

- Calculate value at risk accurately in real financial impact terms.

- Assess systems/NIST controls for effectiveness against cyber threats.

- Explain cyber security risk to the Board and Stakeholders.

- Mitigate supply chain compromise threat vectors.

Delta RQ integrates confidential data that is held by cyber insurers on historical cyber breaches that have occurred - including detailed information on any ransomware payments made, which are typically not publicly available.

Explain cyber security risk to the board and stakeholders

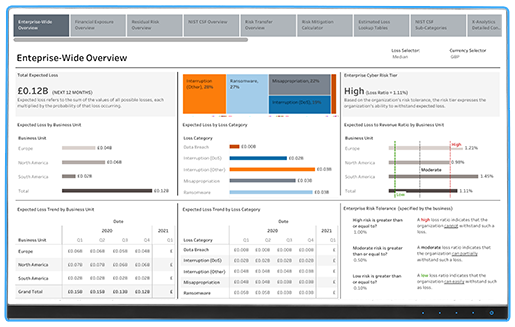

CISOs have often struggled to explain cyber risk in a way that enables business decision making. This is often because they cannot link technical risks with business risks in financial terms. The rising tide of cyber security breaches is having a significant impact on the balance sheet of businesses. Delta RQ enables management of cyber security risk as a business risk with accurate financial quantification.

Improve your cyber security strategy

Delta RQ enables businesses to calculate their expected losses due to a cyber attack and to determine the worst case scenarios for cyber insurance purposes. The solution also enables businesses to assess the expected loss reduction of implementing individual cyber security controls or making changes to cyber security strategy. Thus, enabling optimal decision making on cyber security investments.

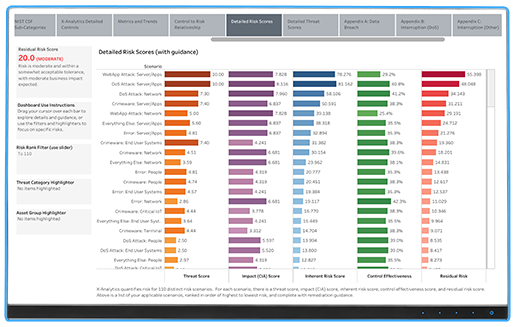

Identify the most significant risks

Delta RQ generates a view of the threats posed by various attack vectors, specific to the customer organisation and provides a view of how they compare to an industry baseline. Dramatically increase your operational efficiency with Delta RQ’s innovative risk scoring system based on an attacker’s priorities. Delta RQ assesses up to 110 risk scenarios and provides scoring for Threat, Impact, Implicit Risk and Control Effectiveness.

Delta RQ is powered by X-Analytics, a patented state-of-the-art cyber risk financial analytics application trusted by leaders in the global cyber insurance industry to understand financial exposure to cyber risk and make cyber insurance underwriting decisions.